We help you to accurately calculate the cost of injection molds. This is important for the production costs. With our tool, you can easily calculate the costs by uploading your 3D file.

Our solution makes it easy to know the exact costs. So you can improve your production. For example, you can use polymethyl methacrylate (PMMA) in injection molding.

Headlines

- The depreciation of injection molds is an important aspect of production costs.

- We help you to calculate your production costs simply by uploading your 3D file.

- Our innovative solution enables you to calculate your production costs precisely and optimize your production.

- Accounting in Germany plays an important role in the depreciation of injection molds.

- We support you in the depreciation of injection molds in order to calculate your production costs accurately.

- The depreciation of injection molds can be calculated easily and accurately with our solution.

Basics of tool depreciation in injection molding

Tool depreciation in injection molding is an important part of production costs. We explain the basics of tool depreciation and the special features of injection molding tools. Our experts will help you to understand the laws and carry out depreciation correctly.

Tool depreciation is the depreciation of injection molding tools in accounting. It is important in order to calculate the production costs accurately. The depreciation is distributed over the useful life of the tool.

Definition of amortization

Depreciation distributes the acquisition costs of a tool over its useful life. This is necessary in order to calculate the production costs correctly.

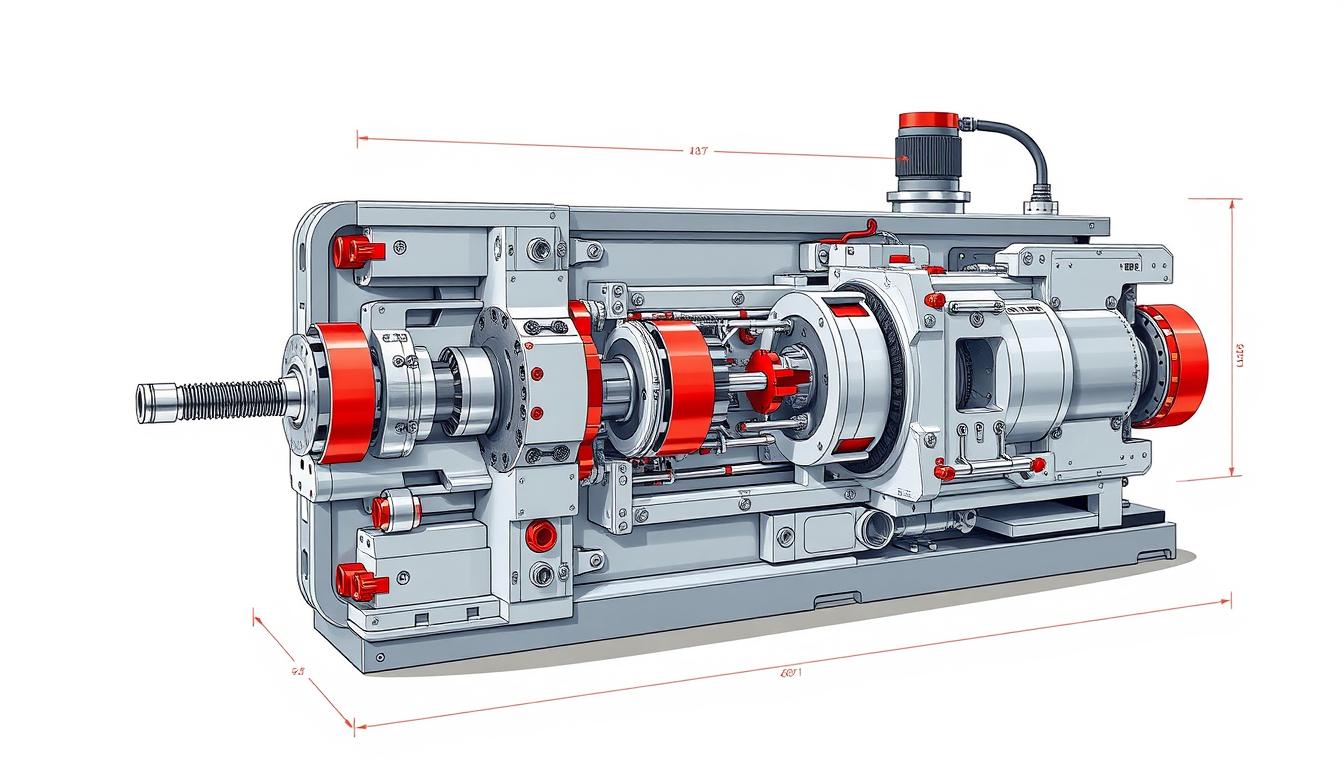

Special features of injection molds

Injection molding tools have special features. These must be taken into account in depreciation. These include the injection molding technology and the specific requirements for the tools.

Relevant legal bases

The laws for tool depreciation in injection molding are the German Commercial Code (HGB) and the German Fiscal Code (AO). Our experts will help you to understand these laws and carry out depreciation correctly.

Copying injection molding tools: Methods and procedure

The depreciation of injection molds is important in accounting. There are various methods, such as straight-line and declining balance depreciation. The choice depends on the needs of the company.

In order to depreciate injection molds, companies must use the appropriate methods. They must determine the costs, estimate the useful life and choose the best depreciation method.

The most important steps for copying injection molds are:

- Determination of acquisition costs

- Estimation of useful life

- Estimating the selection of the correct type of depreciation

By following these steps and using the right methods, companies can properly depreciate their injection molds. This will improve their accounting.

Useful life and amortization periods

The useful life and depreciation periods are very important. They determine how long you can use a tool. We support you in finding the economic useful life and understanding the service life of the tool.

To determine the economic life, we need to consider many things. For example:

- How many parts are produced?

- What materials are used?

- How is the tool maintained?

The depreciation periods depend on the useful life. It is important to plan these well. This is how to achieve the best depreciation. Our experts will help you find the right periods for your injection molds.

Valuation and capitalization of tool costs

The evaluation of tool costs is very important. It helps to plan the costs of injection molds correctly. We support you in correctly evaluating and capitalizing your tool costs.

Our experts carry out various steps. They analyze the acquisition costs and useful life. This ensures that your decisions are good for your company.

- Analysis of acquisition costs

- Consideration of the amortization periods

- Determination of useful life

The correct evaluation and capitalization of your tool costs improves your company’s profitability. Our solutions help you to optimize your tool costs.

Tax aspects of tool depreciation

Tax aspects are very important when depreciating injection molds. We support you in finding the right tax treatment. Tool depreciation concerns the wear and tear of tools for injection molding production.

The GWG regulations play a major role. They determine how you can deduct tools. Our experts ensure that you apply these rules correctly.

Important aspects of tax treatment

- The tax aspects of tool depreciation include the depreciation of tools used for the production of injection molded articles.

- The GWG regulations stipulate how tools can be depreciated and which requirements must be met.

- The correct application of the GWG rules is important to ensure optimum tool depreciation.

We help you to understand the tax aspects of your injection molds. This will ensure that you apply the GWG regulations correctly. Our expertise helps you to handle everything correctly.

Digital acquisition and documentation

Digital recording and documentation are very important. They help us to document your injection molds correctly.

Tool depreciation gets better with digital methods. Here are some important steps:

- Creation of a digital tool catalog

- Documentation of tool use and maintenance

- Regular checking and updating of tool data

These steps make tool depreciation more efficient. Our experts will help you to record and document your tools correctly.

International accounting standards

International accounting standards are very important for the depreciation of injection molds. We support you in finding the right international accounting standards for your tools. The IFRS treatment of tools is a central point here.

The IFRS determine how tools must be deducted. In contrast, the HGB provides instructions in Germany. It is crucial to know the differences between HGB and IFRS.

We offer you our expertise for the correct depreciation of your injection molds. Our services include:

- IFRS treatment of tools

- Differences between HGB and IFRS

- Correct depreciation of injection molds

We are happy to help you with the depreciation of your injection molds. Contact us to find out more about our services.

Practical examples of tool depreciation

We help companies to apply tool depreciation correctly. The depreciation of tools is important for accounting purposes. It takes into account the costs of purchase and maintenance. This enables companies to reduce their taxes.

When it comes to tool depreciation, the calculation of depreciation rates is crucial. There are various methods, such as straight-line or declining balance depreciation. We find the best method for each company and calculate the depreciation rates precisely.

Calculation of depreciation rates

Depreciation rates are usually calculated according to acquisition costs and useful life. We help you to determine these costs and useful lives. This is how we calculate the correct depreciation rates.

Posting records and account assignment

Posting records and account assignment are also important. We support companies in carrying these out correctly. This results in clear financial reports.

Our experts help to optimize tool depreciation. This enables companies to reduce their taxes and have clear financial reports. Correct application improves competitiveness.

- Practical examples of tool depreciation

- Calculation of depreciation rates

- Posting records and account assignment

Optimization of tool economy

Optimizing tool efficiency is very important. It helps companies to reduce their production costs. This allows them to compete better.

To improve tool management, companies need to calculate their tool costs accurately. They should also keep an eye on their production costs. Tool economy tools help to monitor everything.

Important steps towards improvement are:

- More precise calculation of production costs

- Monitoring tool costs

- Use of tool management tools

Companies can reduce their costs through better tool management. It is important to calculate tool costs accurately. This enables them to achieve better profitability.

Avoid legal and tax pitfalls

Caution is required when depreciating injection molds. We support you in acting in a legally and fiscally correct manner. Our experts are familiar with injection molds and will help you to meet all requirements.

Frequent errors can cause legal and tax problems. These include incorrect documentation requirements, inaccurate tax information and a lack of legal review. Careful planning and monitoring are therefore important.

Important legal and tax issues in the depreciation of injection molds are:

- Legal requirements for the documentation and retention of records

- Tax aspects of depreciation, such as choosing the right type of depreciation

- Pitfalls in the application of special depreciation allowances and other tax benefits

- Documentation requirements for the transfer of injection molds

We support you in meeting these legal and tax requirements. Our experts will answer your questions and help you with implementation.

Conclusion

The correct depreciation of injection molds is very important. It helps to reduce manufacturing costs. Through precise analysis and the right methods, you can increase your profits.

Our team will help you to do depreciation correctly in your accounting. We explain the laws to you, provide support with digital documentation and show you how you can save on taxes.

Take advantage of our experience to reduce your costs. Contact us for a consultation.

FAQ

What are the basics of tool depreciation in injection molding?

The depreciation of injection molds is an important part of production costs. We explain what depreciation means and how it works with injection molds. We also talk about the laws that apply here.

How do you mark up injection molds correctly?

The correct depreciation of injection molds is important. We will show you how to do it correctly. There are various methods and procedures for this.

How is the useful life and depreciation period of injection molds determined?

The useful life and depreciation periods are crucial. We explain how to determine these. You need to consider the economic and technical aspects.

How are tool costs valued and capitalized?

The valuation and capitalization of tool costs is an important step. Wir zeigen Ihnen, wie Sie dies korrekt durchführen.

What tax aspects need to be considered when depreciating tools?

Tax aspects are important. We talk about the GWG regulations and special depreciation options.

How is the digital recording and documentation of injection molds carried out?

Digital recording and documentation are important. We explain how to do this correctly.

How are international accounting standards taken into account in tool depreciation?

International accounting standards are important. We talk about the IFRS treatment of tools and the differences to HGB.

What are practical examples of tool depreciation?

Practical examples are useful. We show you how to calculate depreciation rates and carry out posting records.

How can tool efficiency be optimized?

Optimizing tool economy is important. We explain how you can improve efficiency and reduce production costs.

How do you avoid legal and tax pitfalls when depreciating tools?

Legal and tax pitfalls must be avoided. We explain how to avoid common mistakes and fulfill documentation obligations.